"Nibbles" (nibbles)

"Nibbles" (nibbles)

02/05/2018 at 12:10 ē Filed to: None

1

1

83

83

"Nibbles" (nibbles)

"Nibbles" (nibbles)

02/05/2018 at 12:10 ē Filed to: None |  1 1

|  83 83 |

ď...if youíre buying a house, it shouldnít cost more than twice your income.Ē

Itís not double my income, though it is representative of the housing market. That Zestimate* tho

How many living in metropolitan areas could feasibly do this? Twice my income (and itís a pretty good income) couldnít buy a house in my shitty, shitty neighborhood. My house is worth more than double - itís nearing over triple - my income. Thank gof I bought in 2012, right? RECESSION! BURSTING BUBBLES!

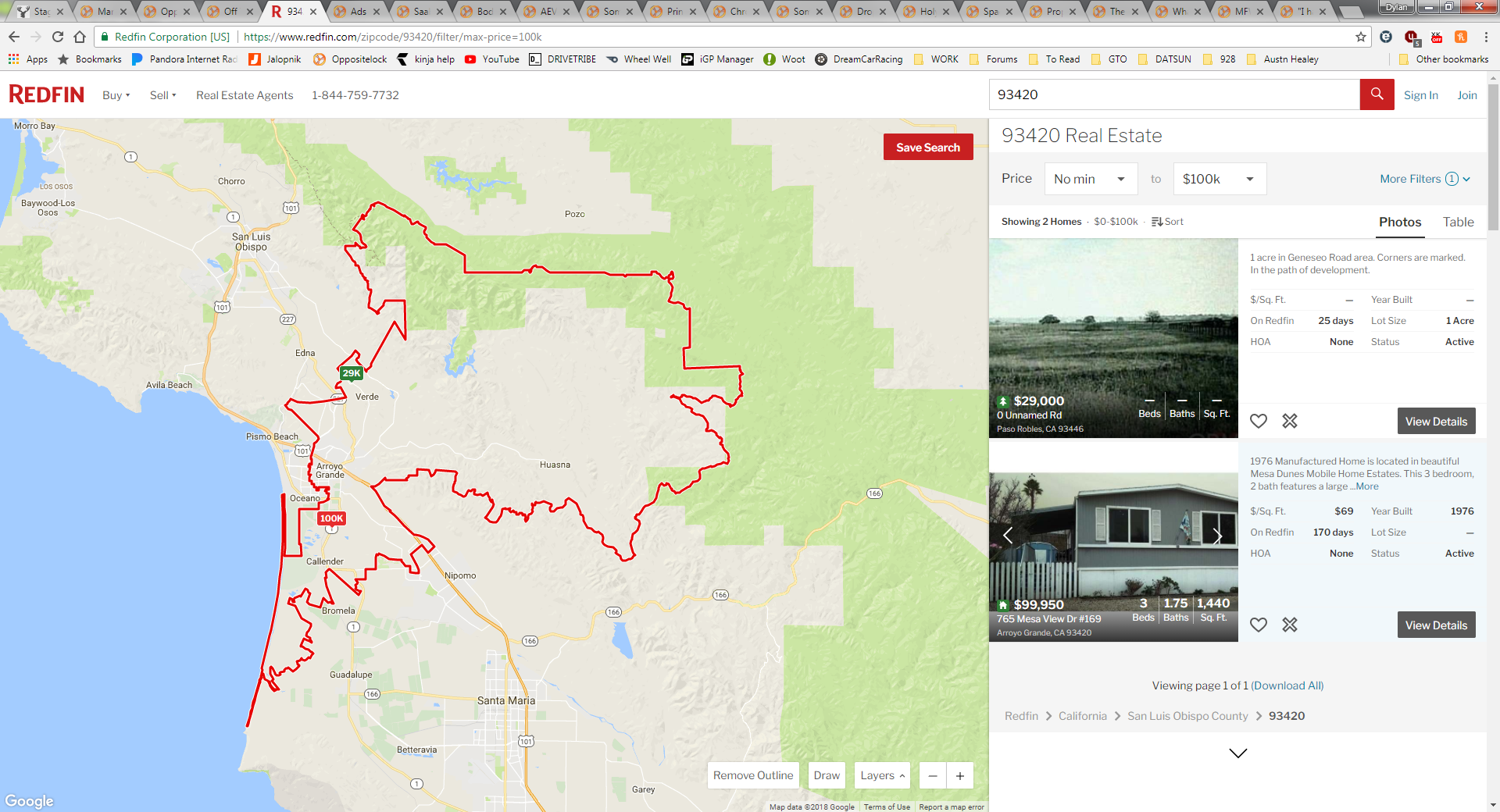

But seriously. Take your income, double it, and find something youíd be happy to live in for the rest of your life in your area. For me, Iíve already tried. Nothing but mobile homes, condos and vacant lots

ttyymmnn

> Nibbles

ttyymmnn

> Nibbles

02/05/2018 at 12:28 |

|

Remember, that speech was made in 1968. A lot has changed since then.

E90M3

> ttyymmnn

E90M3

> ttyymmnn

02/05/2018 at 12:29 |

|

Really?

Sent from my iPhone.

Wacko

> Nibbles

Wacko

> Nibbles

02/05/2018 at 12:29 |

|

really my house is worth almost 6 times my income.

I owe about 3 times my income on it.

Nibbles

> ttyymmnn

Nibbles

> ttyymmnn

02/05/2018 at 12:30 |

|

Of course a lot has changed. Iím not questioning that. I just want to know what kind of homes yíall could find, in your area of choice, for double your income or less, and whether or not those homes would be something youíd be willing to live in for a large chunk of your life.

Neil drives a beetle and a fancy beetle

> Nibbles

Neil drives a beetle and a fancy beetle

> Nibbles

02/05/2018 at 12:32 |

|

My income or my wife and I? Cause if itís just mine; yeah we are talking crappy condo/townhouse. If itís combined; itís pretty spot on for my wife and I.

Nibbles

> Wacko

Nibbles

> Wacko

02/05/2018 at 12:32 |

|

We owe roughly double my income. Weíre hoping to sell soon so we can put roughly 1x my income in our pocket for a short period until we use that 1x my income as a down payment on a house that is likely to be 4.5x to 5x my income

Nick Has an Exocet

> Nibbles

Nick Has an Exocet

> Nibbles

02/05/2018 at 12:32 |

|

The single thing available for twice my income is a lot with no street access on a ď35 degree gradeĒ.

Nibbles

> Neil drives a beetle and a fancy beetle

Nibbles

> Neil drives a beetle and a fancy beetle

02/05/2018 at 12:33 |

|

Not just your income. Your household income is good.

Unfortunately my household currently only has my income to work off of, which really kinda sucks

fintail

> Nibbles

fintail

> Nibbles

02/05/2018 at 12:33 |

|

This might have worked for the lucky generation (in terms of housing costs), I canít imagine how it would work today. I use a workable mortgage:income ratio of around 3-3.5:1, and even then, it wonít work here unless you want a long long commute or a condo as old as me.

In my insane bubbly speculative casino sketchy money dumping ground of a real estate market, houses that were 3x income in 1985 are now 10-15x the equivalent income today.

vondon302

> Nibbles

vondon302

> Nibbles

02/05/2018 at 12:34 |

|

Your wife is supposed to be half your age and plus seven years too but I messed that one up also.

WilliamsSW

> Nibbles

WilliamsSW

> Nibbles

02/05/2018 at 12:34 |

|

That line struck me, too - my how much times have changed.

But, on the flip side, thereís no way in hell I would spend 1/2 of my annual income on a car - itís actually quite a bit less than that.

ttyymmnn

> Nibbles

ttyymmnn

> Nibbles

02/05/2018 at 12:35 |

|

I see. In that case, our house, purchased 15 years ago, was probably about 2x our income at the time (I was working PT, my wife FT). Now, with three kids, itís a bit small. But weíre not moving.

Nibbles

> Nick Has an Exocet

Nibbles

> Nick Has an Exocet

02/05/2018 at 12:35 |

|

Nice view tho

ttyymmnn

> E90M3

ttyymmnn

> E90M3

02/05/2018 at 12:38 |

|

Rally.

Nibbles

> vondon302

Nibbles

> vondon302

02/05/2018 at 12:38 |

|

How does that even

Iím doing the numbers and

Yes Iíd reckon thatís supposed to be 1/2+7 at a specific point in time but Iím imagining the amazing fluctuating-age wife that somehow is near half your age at any given time

TheRealBicycleBuck

> Nibbles

TheRealBicycleBuck

> Nibbles

02/05/2018 at 12:38 |

|

Works for me. Our house to income ratio is about 1.5. We could get a lot more house at that ratio if we lived in a different market. We could also get a lot less house if we moved to New York or California.

Nibbles

> ttyymmnn

Nibbles

> ttyymmnn

02/05/2018 at 12:39 |

|

But what about now? Anything meeting those criteria in your area?

Ash78, voting early and often

> Nibbles

Ash78, voting early and often

> Nibbles

02/05/2018 at 12:39 |

|

This is way outdated advice. Sure, itís okay, but itís way too conservative as lending standards and asset prices have changed. Same with the car thing (half your income).

Doing things as a multiple of income will help manage your cash flow, but it almost ignores your balance sheet and the other source of cash flows: asset conversion.

This is basically like saying ďTo be a good football player, either pass or run the ball.Ē

ttyymmnn

> Nibbles

ttyymmnn

> Nibbles

02/05/2018 at 12:40 |

|

Probably not. We paid about $135k for our house 15 years ago, similar homes today are pushing $230k. Itís crazy.

nermal

> ttyymmnn

nermal

> ttyymmnn

02/05/2018 at 12:40 |

|

Just look at how far trucks have advanced!

Nibbles

> WilliamsSW

Nibbles

> WilliamsSW

02/05/2018 at 12:41 |

|

Iím actually surprised, thinking back to that loan. We bought our truck last year for, at the time, right near 1/2 my annual. Not too bad.

*My* car, on the other hand, was roughly 2% of my annual.

Brian, The Life of

> Nibbles

Brian, The Life of

> Nibbles

02/05/2018 at 12:42 |

|

TIL there actually

is

a single family home in the San Diego area that costs (roughly) twice our household income. I just wouldnít want to live there.

Quadradeuce

> Nibbles

Quadradeuce

> Nibbles

02/05/2018 at 12:42 |

|

When we bought our house, we were below that mark. Probably 1.5x our yearly income. It helps to be professionals DINKS in flyover country, and to buy a fixer-upper. Now we make more per year that we paid for our house, but also have 2 kids.

Highlander-Datsuns are Forever

> Nibbles

Highlander-Datsuns are Forever

> Nibbles

02/05/2018 at 12:42 |

|

My house is 3x my income but with interest rates as low as they are that probably works out to about the same monthly payment on a 30 year fixed, as it did 30 or 40 years ago, maybe even less.

ttyymmnn

> nermal

ttyymmnn

> nermal

02/05/2018 at 12:43 |

|

Iíll take the Ď68.

Nibbles

> ttyymmnn

Nibbles

> ttyymmnn

02/05/2018 at 12:43 |

|

I hear ya, and itís what Iím getting at. We paid a high $160 in 2012 and are looking at selling in the $320-330 range.

Quadradeuce

> Nibbles

Quadradeuce

> Nibbles

02/05/2018 at 12:43 |

|

Also, that trailer would be $15k in our market. I know, because my coworkerís mom just sold hers for that amount, and it was well maintained but about the same age as that picture.

Nibbles

> Brian, The Life of

Nibbles

> Brian, The Life of

02/05/2018 at 12:44 |

|

Chroist

nermal

> Nibbles

nermal

> Nibbles

02/05/2018 at 12:44 |

|

You just have to keep dumping them and getting new ones. Kinda like leasing a new BMW every three years. Itís not the cheapest way to do things, but thatís why you work harder.

Nibbles

> Highlander-Datsuns are Forever

Nibbles

> Highlander-Datsuns are Forever

02/05/2018 at 12:45 |

|

Good point on the interest rate bit.

random001

> Nibbles

random001

> Nibbles

02/05/2018 at 12:47 |

|

Mine actually cost less, but is worth more. Paradox!

Nibbles

> Quadradeuce

Nibbles

> Quadradeuce

02/05/2018 at 12:47 |

|

Funny thing. Our first foray into home ownership was a mobile home. Bought one a bit north for $10k. Lived in it for a couple years whilst pillaging the local Habitat for Humanity store for all kinds of bits, and sold it for $16k. There was our down for our first ďrealĒ house which we bought, at the *perfect* time, for $160k. Looking to sell that soon and expecting to see somewhere in the $320-$330k range.

Nibbles

> Quadradeuce

Nibbles

> Quadradeuce

02/05/2018 at 12:51 |

|

I canít wait to be professional DINKs

CalzoneGolem

> Nibbles

CalzoneGolem

> Nibbles

02/05/2018 at 12:52 |

|

Our house is slightly more than twice my income but way less than twice our income and we have a 3.8 acre lot.

punkgoose17

> Nibbles

punkgoose17

> Nibbles

02/05/2018 at 12:53 |

|

I spent 2.25 times my income on my house in 2016. But I also have 1.6 times my income in student loan debt which was not a thing that happened in 1968.

Kiltedpadre

> Nibbles

Kiltedpadre

> Nibbles

02/05/2018 at 12:55 |

|

One advantage of not living in a major metropolitan area is there are actually a lot of options that meet that criteria for me. This would be less than 1.5x and is a decent sized house with two car garage.

https://www.zillow.com/homedetails/506-Wilson-Park-Dr-Miamisburg-OH-45342/35001019_zpid/

HFV has no HFV. But somehow has 2 motorcycles

> Nibbles

HFV has no HFV. But somehow has 2 motorcycles

> Nibbles

02/05/2018 at 12:56 |

|

If you are counting our combined income my Wife and I did this. However we live in a town of 9,000 not exactly metropolitan.

But our combined annual is about 55,000 and our house was 80,000. Granted itís also a 100 year old house on quarter of an acre.

Nibbles

> CalzoneGolem

Nibbles

> CalzoneGolem

02/05/2018 at 12:57 |

|

DAG

My wife would kill for that kind of acreage

Nibbles

> Kiltedpadre

Nibbles

> Kiltedpadre

02/05/2018 at 12:59 |

|

Thatís downright livable

Except that kitchen. I abhor that kitchen

But otherwise, downright livable!

HFV has no HFV. But somehow has 2 motorcycles

> Brian, The Life of

HFV has no HFV. But somehow has 2 motorcycles

> Brian, The Life of

02/05/2018 at 13:00 |

|

Holy shit. That would be a 30,000 dollar house where I live. Maybe 40 if itís nice on the instide And has a decent back yard.

CalzoneGolem

> Nibbles

CalzoneGolem

> Nibbles

02/05/2018 at 13:01 |

|

When you live in the woods shitís cheap son.

MasterMario - Keeper of the V8s

> Nibbles

MasterMario - Keeper of the V8s

> Nibbles

02/05/2018 at 13:01 |

|

Thatís even better than mine...my daily is about 4% of my annual

vondon302

> Nibbles

vondon302

> Nibbles

02/05/2018 at 13:02 |

|

When you first marry them lol.

Nibbles

> HFV has no HFV. But somehow has 2 motorcycles

Nibbles

> HFV has no HFV. But somehow has 2 motorcycles

02/05/2018 at 13:02 |

|

Thatís pretty cool though. My wife would kill me but Iíd love to get an old house.

HFV has no HFV. But somehow has 2 motorcycles

> WilliamsSW

HFV has no HFV. But somehow has 2 motorcycles

> WilliamsSW

02/05/2018 at 13:02 |

|

Yeah I spend 1/4 my income on my car, and that just MY income not my families combined. I suppose if my wife also had a car payment hers would be higher but she also makes a fair bit more than me.

WilliamsSW

> Nibbles

WilliamsSW

> Nibbles

02/05/2018 at 13:04 |

|

That should be an Oppo award - DD value divided by annual income, whoís got the lowest?

That 2% is a front runner for sure!

WilliamsSW

> HFV has no HFV. But somehow has 2 motorcycles

WilliamsSW

> HFV has no HFV. But somehow has 2 motorcycles

02/05/2018 at 13:05 |

|

Yeah, mine is around 30% of my own income, give or take, and my wifeís is less than that.

HFV has no HFV. But somehow has 2 motorcycles

> Nibbles

HFV has no HFV. But somehow has 2 motorcycles

> Nibbles

02/05/2018 at 13:06 |

|

Itís not a nice old house, just an old one. I guess it has more character than your average prefab but remodel after, renovation, and being turned into a triplex, and then now a duplex. After all that a lot of the charm it probably once had is gone. It is great having rental income tho.

HFV has no HFV. But somehow has 2 motorcycles

> WilliamsSW

HFV has no HFV. But somehow has 2 motorcycles

> WilliamsSW

02/05/2018 at 13:09 |

|

Actually I was thinking about that wrong. I was just thinking monthly expense/monthly income. If your talking price of the car/annual income, than mine is pretty close to half my annual income. But thatís why I have a 4 year loan on it. Although I do plan on paying it off in two, but I couldnít do that if not for my wifeís income, and our tax returns.

facw

> Nibbles

facw

> Nibbles

02/05/2018 at 13:10 |

|

More specifically, you are not supposed to date anyone less than half your age plus 7. So if Iím 36, it would be weird for me to date someone younger than 25. Thereís an implied upper bound as well, since the same ďruleĒ would say that a 58 year old is the oldest person who could date me without it being creepy. So you get a range of acceptable options.

MasterMario - Keeper of the V8s

> Nibbles

MasterMario - Keeper of the V8s

> Nibbles

02/05/2018 at 13:11 |

|

We actually did only pay about 2x our income for our house, we also live in the Midwest and donít have kids yet.

facw

> Nibbles

facw

> Nibbles

02/05/2018 at 13:12 |

|

The guideline Iíve read is to spend less than 5 times your household income, which fits a lot better, though even that can give you some pretty limited options in more expensive markets.

Mid Engine

> Nibbles

Mid Engine

> Nibbles

02/05/2018 at 13:14 |

|

https://www.redfin.com/WA/Bothell/4209-164th-Pl-SE-98012/home/12490545

punkgoose17

> WilliamsSW

punkgoose17

> WilliamsSW

02/05/2018 at 13:15 |

|

I am also at 2% but my car currently wonít pass inspection and has been in the driveway or garage for 6 months, and I am using my wifeís car. I do not win.

Future next gen S2000 owner

> Nibbles

Future next gen S2000 owner

> Nibbles

02/05/2018 at 13:19 |

|

The missus and I make decent money. We live in a crazy real estate market. I now realize why people stay in their home for decades. I like my mortgage.

TheBloody, Oppositelock lives on in our shitposts.

> Nibbles

TheBloody, Oppositelock lives on in our shitposts.

> Nibbles

02/05/2018 at 13:21 |

|

To be fair that speech was given in a time when you could pay for college by just working part time. That being said, our house is a 1 1/4 of what we make in a year but I have a 90 minute commute one way so there is that.

punkgoose17

> Nick Has an Exocet

punkgoose17

> Nick Has an Exocet

02/05/2018 at 13:30 |

|

Just build 1o feet deep and 3 to 4 stories high. This building actually is probably 20 feet deep on the upper stories.

WilliamsSW

> punkgoose17

WilliamsSW

> punkgoose17

02/05/2018 at 13:36 |

|

Yeah, I think weíd have to include a requirement that the car is drivable. Hopefully you can get it to pass soon - or move to a state that doesnít require itó

Nick Has an Exocet

> punkgoose17

Nick Has an Exocet

> punkgoose17

02/05/2018 at 13:37 |

|

lol, do you have earthquakes where you live? The cost of building on that kind of land is insane.

punkgoose17

> WilliamsSW

punkgoose17

> WilliamsSW

02/05/2018 at 13:41 |

|

I am stuck waiting for warmer weather so filler and paint will dry. It is much better than it was. I am hoping to slow down the rust.

punkgoose17

> Nick Has an Exocet

punkgoose17

> Nick Has an Exocet

02/05/2018 at 13:48 |

|

No we do not have earth quakes. There are not many major weather disasters where I live.

Also, we do have a fair amount of interestingly located old houses on the sides of hills built before cars were the major transportation.

Nibbles

> punkgoose17

Nibbles

> punkgoose17

02/05/2018 at 14:09 |

|

Donít feel too bad. Mineís currently in my in-lawsí garage (because we canít afford a garage in this market lol) torn down to the block.

Nibbles

> TheBloody, Oppositelock lives on in our shitposts.

Nibbles

> TheBloody, Oppositelock lives on in our shitposts.

02/05/2018 at 14:12 |

|

If I drove, Iíd have an hour commute. For what amounts to 10 miles. And $250/mo for parking.

Nibbles

> Mid Engine

Nibbles

> Mid Engine

02/05/2018 at 14:15 |

|

That is at about the max commute (says 45 mins Bothell to Fed Way) that weíd consider. But how often would that 45 mins actually happen I wonder

Mid Engine

> Nibbles

Mid Engine

> Nibbles

02/05/2018 at 14:24 |

|

Depends on the time of day, my wife works downtown Seattle and takes the bus. Commute time is about an hour, sometimes less. I work from home unless Iím visiting Microsoft or Amazon; I set up meetings to avoid the bulk of the traffic whenever possible.

The problem with the Puget Sound area is the costs keep going up exponentially, so you can sell your house and make a tidy profit but then ya gotta find somewhere to live. Iím happy my house has gone up $200k in three years, but if you canít leverage the equity it doesnít matter.

Nibbles

> Mid Engine

Nibbles

> Mid Engine

02/05/2018 at 14:28 |

|

Weíre seriously considering Gig Harbor up to Olalla. Olalla wasnít on my radar until this morning when I found a few gems on a shit-ton of land for very reasonable prices

Mid Engine

> Nibbles

Mid Engine

> Nibbles

02/05/2018 at 14:29 |

|

Gig Harbor means bridge tools, that adds up quick. Take a look around the Carnation/Duval area, pretty easy to bounce to the 520 from there.

Nibbles

> Mid Engine

Nibbles

> Mid Engine

02/05/2018 at 14:38 |

|

Yeah weíve talked about the tolls and are willing to eat that

Duvall is a beautiful little town! Drove through it a couple times and said ďyeah this is probably too expensive for usĒ. Just looked up some homes there, and yup. It is. Their cheap homes are nicking the absolute top of our budget

Of course if weíre not paying tolls, I guess the budget could be amended a tad

Nibbles

> Mid Engine

Nibbles

> Mid Engine

02/05/2018 at 14:42 |

|

For reference, this is right up our alley

Mid Engine

> Nibbles

Mid Engine

> Nibbles

02/05/2018 at 15:09 |

|

Love the shop, Iíd buy it just for the outbuilding and land. Kitchen and bathrooms are a gut job though, that adds up quick.

Nibbles

> Mid Engine

Nibbles

> Mid Engine

02/05/2018 at 15:20 |

|

True dat. But theyíre functional as is so I can work on those bits as I please.

CaptDale - is secretly British

> Mid Engine

CaptDale - is secretly British

> Mid Engine

02/05/2018 at 16:23 |

|

That is really pretty

Kiltedpadre

> Nibbles

Kiltedpadre

> Nibbles

02/05/2018 at 16:25 |

|

Yeah, the kitchen is horrible. Iíd need to see it in person to see if the kitchen could be expanded and improved reasonably.

CaptDale - is secretly British

> Nibbles

CaptDale - is secretly British

> Nibbles

02/05/2018 at 16:30 |

|

2.....

Mid Engine

> CaptDale - is secretly British

Mid Engine

> CaptDale - is secretly British

02/05/2018 at 17:47 |

|

Thanks, Iíve put an additional $30k in upgrades since I bought the house. Labor was free, cuz I do all sorts of handywork. Plenty big since itís just me and missus

TheBloody, Oppositelock lives on in our shitposts.

> Nibbles

TheBloody, Oppositelock lives on in our shitposts.

> Nibbles

02/05/2018 at 18:09 |

|

I take the train, If I drove Iíd be doing about 150 miles a day with about the same travel time.

Dogsatemypants

> Nibbles

Dogsatemypants

> Nibbles

02/05/2018 at 18:33 |

|

I am finding empty lots and mobile homes that i would need to be 20 years older to meet the hoa requirements. F this. Moving to†eastern wa, oregon, or iowa.

Dogsatemypants

> Nibbles

Dogsatemypants

> Nibbles

02/05/2018 at 18:35 |

|

It looks very nice. Modern but not boring. I like your taste.

Dogsatemypants

> Dogsatemypants

Dogsatemypants

> Dogsatemypants

02/05/2018 at 18:39 |

|

Check this place in olalla

http://seattledreamhomes.com/unusual-home-for-sale-near-seattle-fairy-tale-house/

pip bip - choose Corrour

> Nibbles

pip bip - choose Corrour

> Nibbles

02/06/2018 at 04:34 |

|

if that were the case, NO ONE on a working income here in Australia would own a home/mortgage.

Dr. Zoidberg - RIP Oppo

> Mid Engine

Dr. Zoidberg - RIP Oppo

> Mid Engine

03/02/2018 at 21:43 |

|

+$22o,000 of equity in just THREE YEARS...

Dr. Zoidberg - RIP Oppo

> Nibbles

Dr. Zoidberg - RIP Oppo

> Nibbles

03/02/2018 at 21:48 |

|

Double our income couldnít even afford what our current home is allegedly ďworth.Ē

Mid Engine

> Dr. Zoidberg - RIP Oppo

Mid Engine

> Dr. Zoidberg - RIP Oppo

03/03/2018 at 18:19 |

|

I know, my tax increases have followed suit. What the fuck does Washington State do with all the extra tax money theyíre taking in?

Iíve also put another $50k+ into the house, so yeah the value is pretty solid at the moment.